- Washington “follows with interest” Morocco’s openness onto Africa (John Kerry)Posted 11 years ago

- The trial of South African Paralympic champion Oscar Pistorius opened in Pretoria on Monday.Posted 11 years ago

- USA welcomes efforts of King Mohammed VI in MaliPosted 11 years ago

- Egypt’s population reaches 94 millionPosted 11 years ago

- Mugabe celebrates his 90thPosted 11 years ago

- Moroccan Monarch to Build a Perinatal Clinic in BamakoPosted 11 years ago

- King Mohammed VI handed a donation of bovine semen for the benefit of Malian breeders.Posted 11 years ago

- Moroccan King’s strategic tour to Africa: Strengthening the will of pan African Solidarity and stimulating the south-south cooperation mechanisms over the continentPosted 12 years ago

- Senior al-Qaida leader killed in AlgeriaPosted 12 years ago

- Libya: The trial of former Prime Minister al-Baghdadi AliPosted 12 years ago

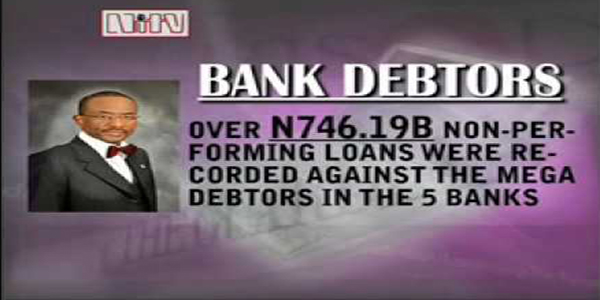

Nigeria: Cleaning up the financial sector

The Nigerian authorities continue unabated the spring cleaning, which began in 2009 in the financial sector. One year after the shock treatment administered to the banking sector: sacking of bankers, injection of 2.8 billion Euros in nine institutions, and strengthening of control; now comes the turn of the microfinance institutions to be cleaned. The banking regulator had announced the revocation of licenses to 224 microfinance institutions, among the 820 established across the country.

The Nigerian authorities continue unabated the spring cleaning, which began in 2009 in the financial sector. One year after the shock treatment administered to the banking sector: sacking of bankers, injection of 2.8 billion Euros in nine institutions, and strengthening of control; now comes the turn of the microfinance institutions to be cleaned. The banking regulator had announced the revocation of licenses to 224 microfinance institutions, among the 820 established across the country.

Some 178 microfinance institutions are technically insolvent, while 46 others are judged definitely bankrupt, said the deputy governor of the Nigerian Central Bank (NCB), responsible for finance stability. He also announced the intention to terminate the model of “the bank doing everything” by separating the business of credit institutions and other speculative activities, such as brokerage and asset management. He is considering that the high level of non-performing loans, the heavy investment on the capital market and poor corporate governance are the main causes of the bankruptcy of the financial institutions. The NCB deputy governor said that the monetary authorities will not allow few individuals whose institutions are failing to undermine the noble mission of the microfinance ones. They would be delivered to the courts to open investigations and lunch prosecutions if needed. He added, those who are found guilty will be put on the blacklist. The 224 reckless microfinance institutions ordered to close will not be the only players to risk trouble with the law, there are some 260 individuals and organizations will be brought to justice for different types of alleged manipulation of stock prices and insider trading. This decision came a week after the sacking of the General Director of the Nigerian Stock Exchange, Ndi Okereke-Onyuike, guilty for mismanagement and lack of foresight. The billionaire Aliko Dangoté, president of the second largest stock exchange in sub-Saharan Africa, was also dismissed for the same reason. Meanwhile, Nigerian authorities announced several measures to restore confidence in the banking industry. Created by presidential decree, the Asset Management Corporation of Nigeria (AMCON) is working since last September to retrieve the toxic assets of banks in Nigeria. This “bad bank”, inspired from a similar structure established by the U.S. government in the wake of the subprime crisis to clean up the bank balance, should acquire all the bad loans estimated to nearly 16 billion Euros. The vast program of reform of the sector is still in its infancy … The withdrawal of the 224 micro-credit institution licenses and the legal action lunched against 260 individuals and institutions for various financial crimes reflect the will of the Nigerian State to clean an area that came close to disaster in 2009.